Three Black Crows Pattern

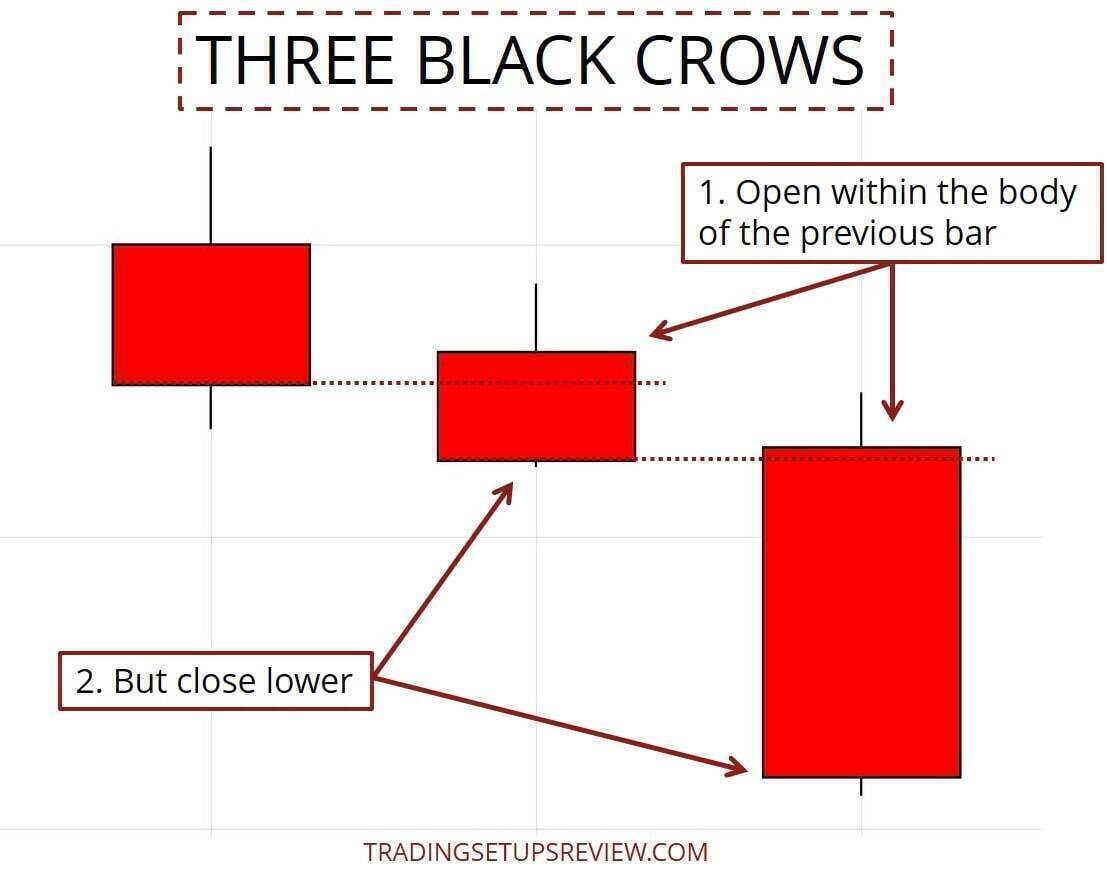

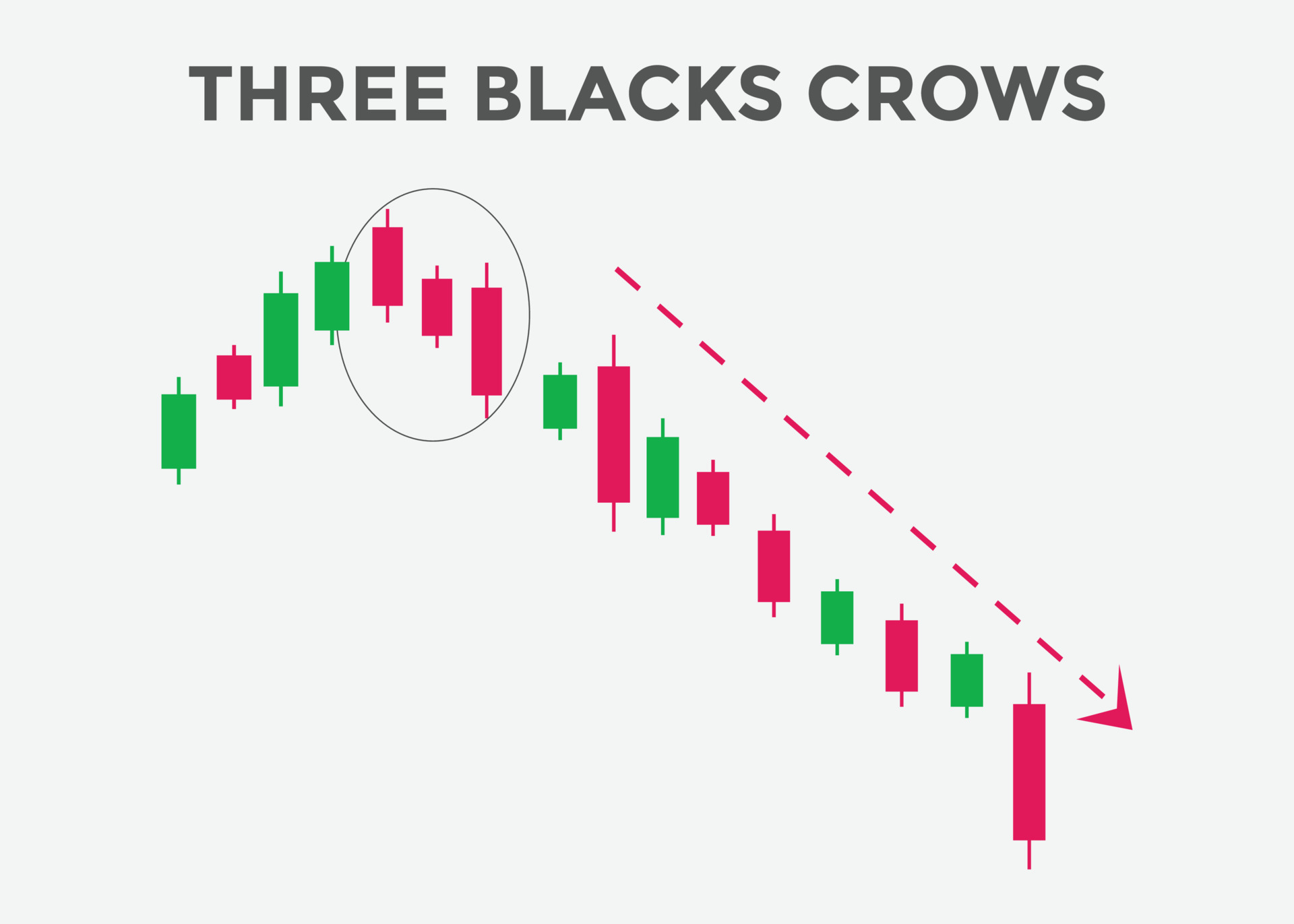

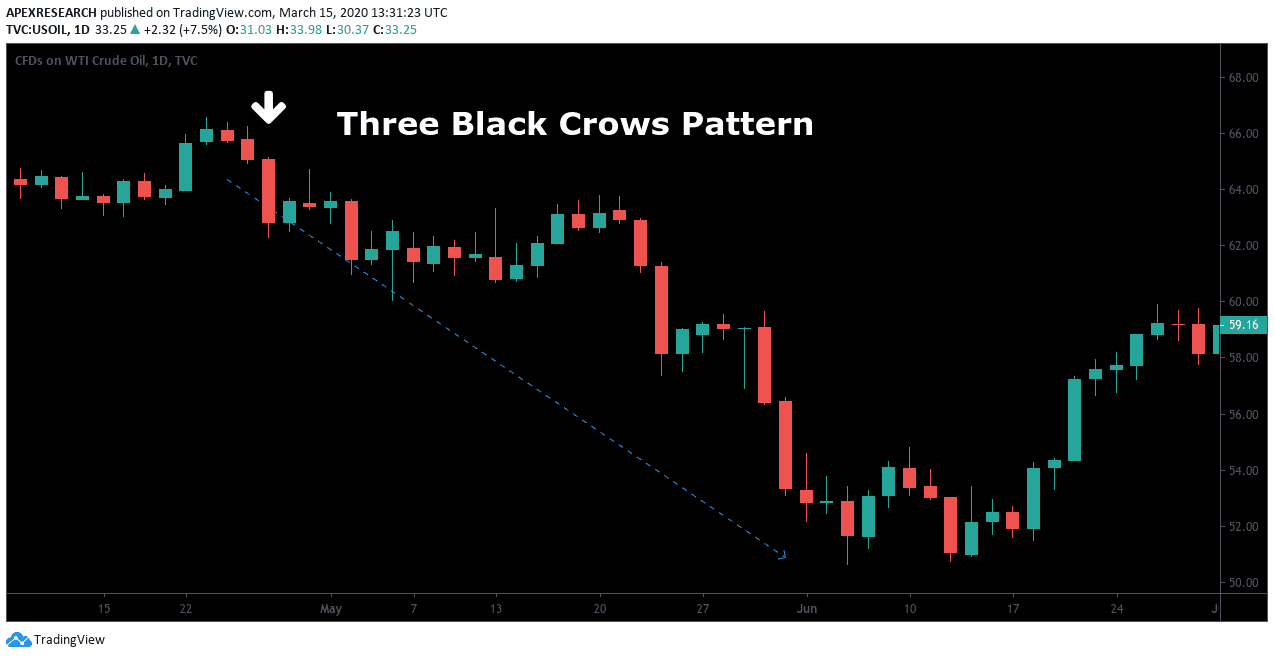

Three Black Crows Pattern - It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. These candles must open within the previous body or near the closing price. The three black crows chart pattern is a bearish reversal candlestick pattern. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. Web what is the three black crows pattern? Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web learn the basics of the three black crows pattern and how analysts and traders interpret this bearish reversal pattern when creating a trading strategy. Learn how it signals bearish trends and shapes trading strategies. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Learn how it signals bearish trends and shapes trading strategies. Traders use it alongside other technical indicators such as the relative. Web learn the basics of the three black crows pattern and how analysts and traders interpret this bearish reversal pattern when creating a trading strategy. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. It indicates a shift in market sentiment from bullish to bearish. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. It indicates a potential reversal from an uptrend to a downtrend. Web what is the three black crows pattern? Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. Three black crows may be commonly found in the cfd markets. The three black crows chart pattern is a bearish reversal candlestick pattern. Learn how it signals bearish trends and shapes trading strategies. Web the three black crows pattern is. Learn how it signals bearish trends and shapes trading strategies. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. Web the three black crows pattern is a bearish. Web what is the three black crows pattern? Learn how it signals bearish trends and shapes trading strategies. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous. Web the three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. It indicates a potential reversal from an uptrend to a downtrend. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. Web the three black. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. The three black crows chart pattern is a bearish reversal candlestick pattern. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. These candles must. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. Web three black crows is a bearish candlestick pattern used to predict the reversal of. Learn how it signals bearish trends and shapes trading strategies. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web uncover the secrets of the three black crows pattern in 2024. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately. It indicates a potential reversal from an uptrend to a downtrend. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. The three black crows chart pattern is a bearish reversal candlestick pattern. Learn how it signals bearish trends and shapes trading strategies. Web learn. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. It indicates a shift in market sentiment from bullish to bearish. Learn how it signals bearish trends and shapes trading strategies. Web what is the three black crows pattern? Web uncover the secrets of the three black crows pattern in. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. The three black crows chart pattern is a bearish reversal candlestick pattern. Web learn the basics of the three black crows pattern and how analysts and traders interpret this bearish reversal pattern when creating a. It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web what is the three black crows pattern? The three black crows chart pattern is a bearish reversal candlestick pattern. Web learn the basics of the three black crows pattern and how analysts and traders interpret this bearish reversal pattern when creating a trading strategy. Web uncover the secrets of the three black crows pattern in 2024. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. Web the “three black crows” is a bearish candlestick pattern having three red (black crow) candles immediately after reversal from an uptrend to a downtrend. It indicates a shift in market sentiment from bullish to bearish. The pattern suggests that after a prolonged bullish trend, increasing selling pressure leads to the formation of three bearish candles. These candles must open within the previous body or near the closing price. Three black crows may be commonly found in the cfd markets. Traders use it alongside other technical indicators such as the relative. It indicates a potential reversal from an uptrend to a downtrend.Three Black Crows Candlestick Pattern Explained LearnX

Three Black Crows candlestick pattern. Powerful bearish Candlestick

How To Trade The Three Black Crows Pattern

Learn How To Trade With Three Black Crows Pattern

Three Black Crows Candlestick Pattern A Guide by Real Traders

How To Trade The Three Black Crows Pattern

Three Black Crows Definition

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

What Are Three Black Crows Candlestick Patterns Explained ELM

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

Web The Three Black Crows Pattern Is A Bearish Reversal Pattern That Consists Of Three Consecutive Bearish Long Candlesticks That Trend Downward Like A Staircase.

Web The Three Black Crows Is A Bearish Reversal Pattern Formed By Three Consecutive Bearish Candles After A Bullish Trend.

Web Three Black Crows Is A Bearish Candlestick Pattern Used To Predict The Reversal Of A Current Uptrend.

Learn How It Signals Bearish Trends And Shapes Trading Strategies.

Related Post:

:max_bytes(150000):strip_icc()/The5MostPowerfulCandlestickPatterns3-f3b280e0165a4b2fa5e5d3b42b36e337.png)