Bearish Candlestick Patterns

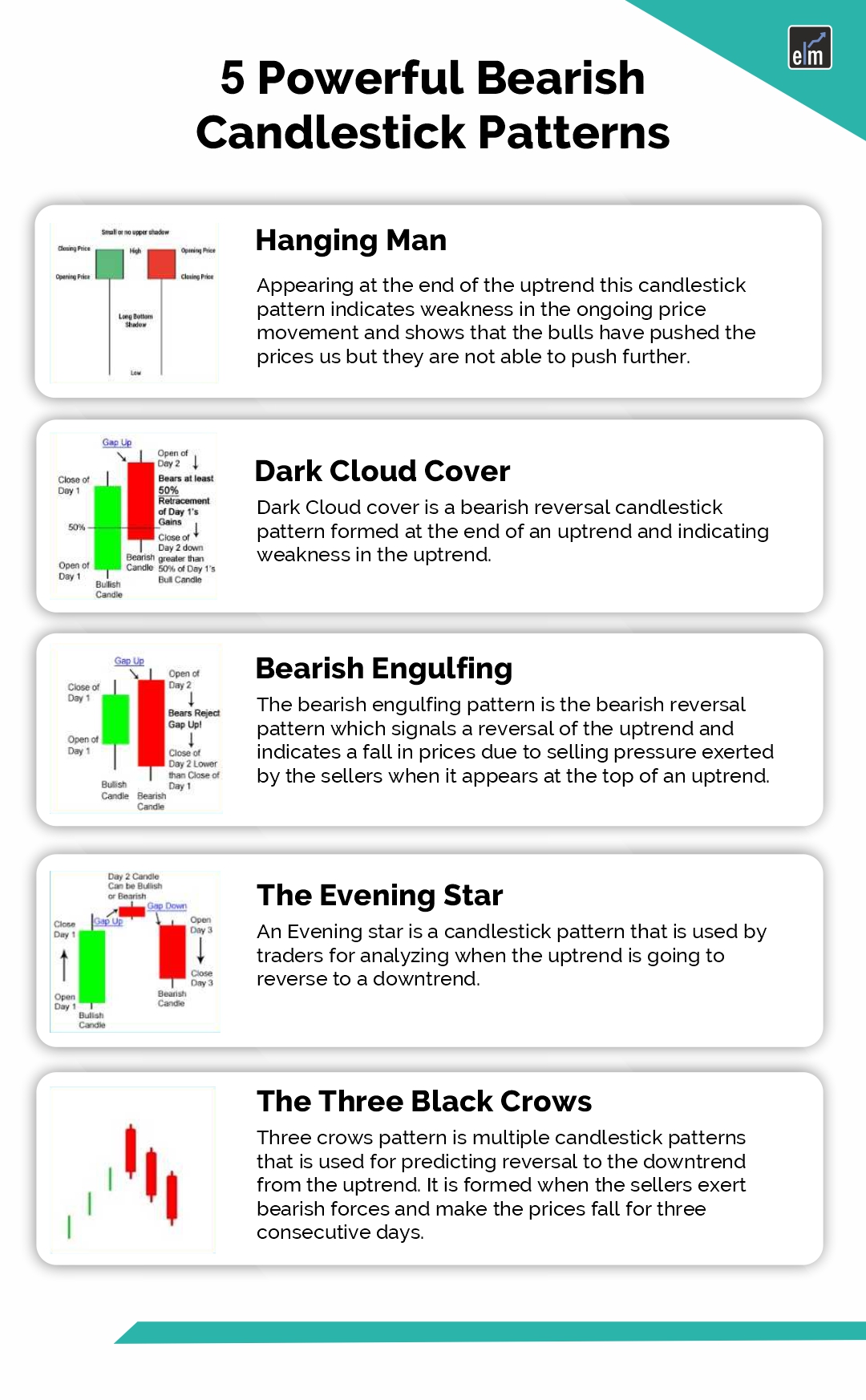

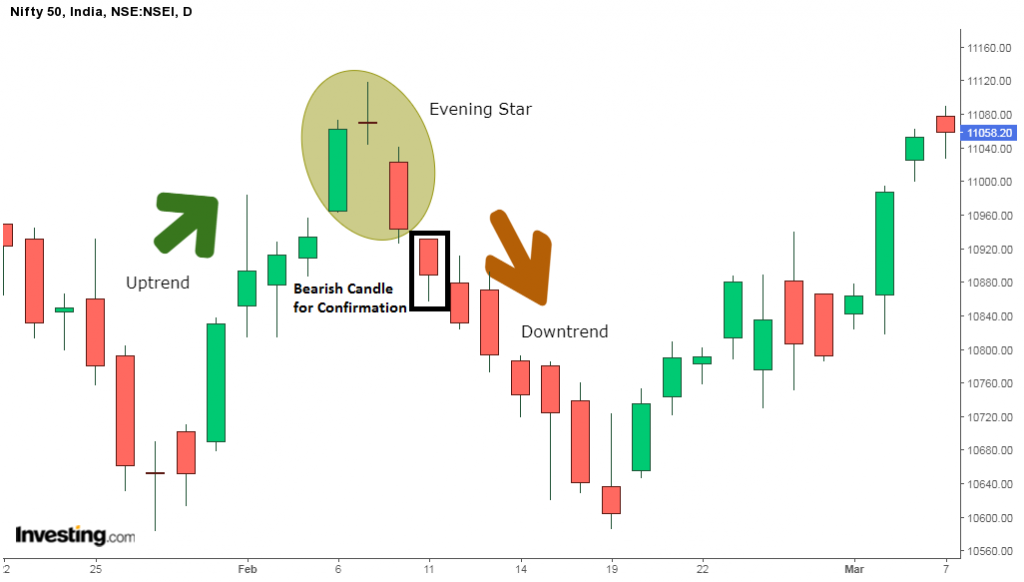

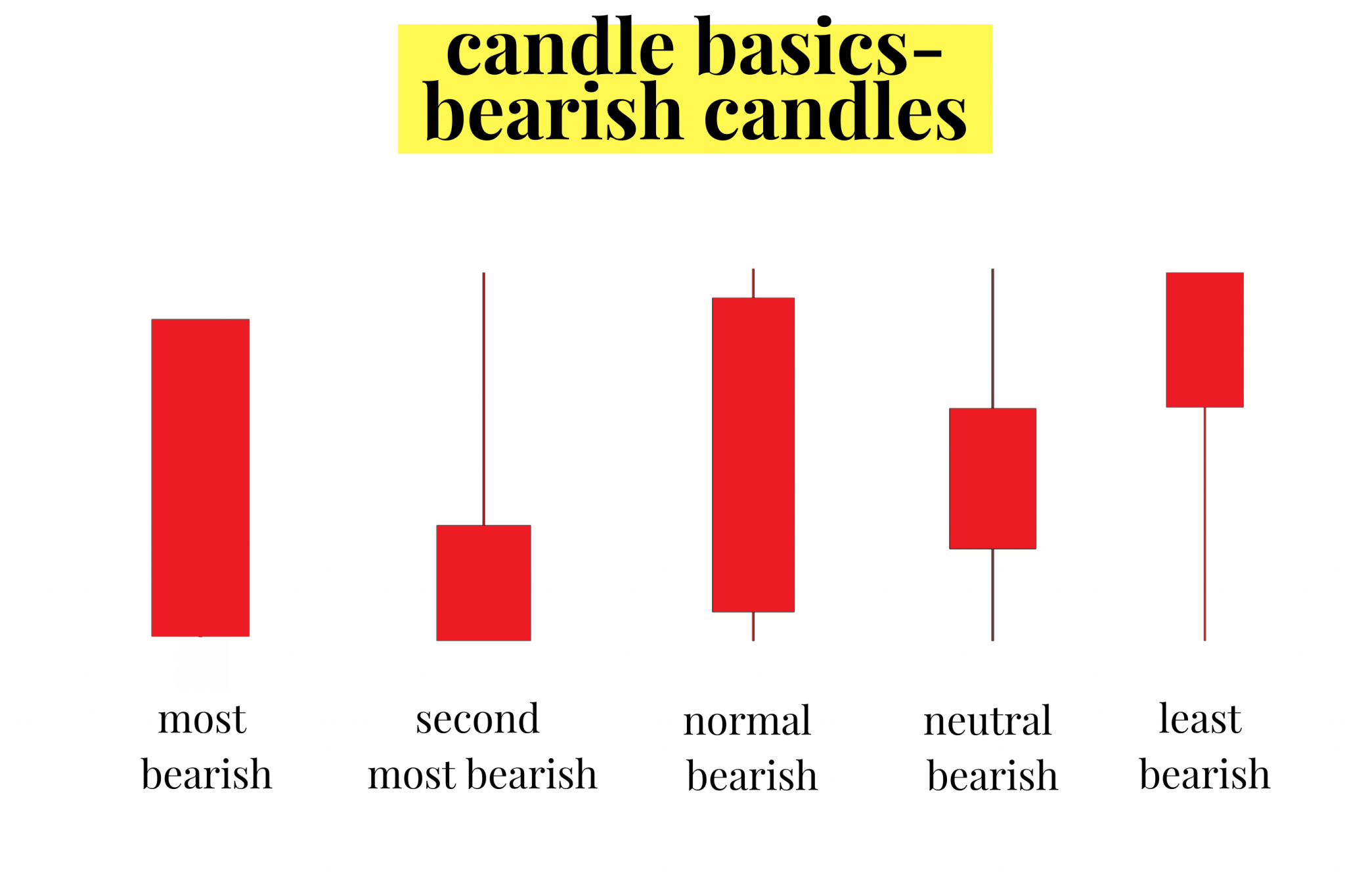

Bearish Candlestick Patterns - Many of these are reversal patterns. These patterns often indicate that sellers are in control, and. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. A bearish candlestick pattern visually represents a market sentiment that suggests a potential price decline. Sure, it is doable, but it requires special training and. Traders use it alongside other technical indicators such as the relative strength. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Trading without candlestick patterns is a lot like flying in the night with no visibility. Web 8 strongest candlestick patterns. They are used by traders to. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Web both bullish and bearish flags indicate that the prevailing power is strong to form a trend. Bearish candlesticks tell you when selling. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). These patterns typically consist of. Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web candlestick patterns are technical trading formations that help visualize the price movement of a liquid asset (stocks, fx, futures, etc.). Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Sure, it is doable, but it requires special training and. Watching a candlestick pattern form can be time consuming and. At some point, the opposing power gains enough control to try and push the price in the. Web the s&p 500 gapped lower on wednesday and ended the session at. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. They are used by traders to. Traders use it alongside other technical indicators such as. Watching a candlestick pattern form can be time consuming and. Web this makes it easier to spot patterns, such as bullish or bearish engulfing patterns, doji. Traders use it alongside other technical indicators such as the relative strength. At some point, the opposing power gains enough control to try and push the price in the. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). A shooting star is a bearish reversal pattern. Patterns are everywhere, some we find in. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. These patterns are formed by the. Web what is a bearish candlestick pattern? Web in candlestick charting, bearish candlestick patterns are specific formations of one or more candlesticks on a price chart that suggest a higher likelihood of a downward. Bearish candlesticks. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. A shooting star is a bearish reversal pattern. Web in technical analysis,. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Web selling candlestick patterns, also known as bearish reversal patterns, are formations on a candlestick chart that suggest a potential shift from an uptrend to a downtrend. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend.. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. A shooting star is a bearish reversal pattern. Heavy pessimism about the market price often causes traders to close their. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Many of these are. Traders use it alongside other technical indicators such as. Web candlestick patterns are technical trading formations that help visualize the price movement of a liquid asset (stocks, fx, futures, etc.). Web this makes it easier to spot patterns, such as bullish or bearish engulfing patterns, doji formations, and morning or evening stars, which are vital for predicting. Web bearish candlestick. Bearish candlesticks tell you when selling. Web what is a bearish candlestick pattern? At some point, the opposing power gains enough control to try and push the price in the. Web both bullish and bearish flags indicate that the prevailing power is strong to form a trend. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls. Trading without candlestick patterns is a lot like flying in the night with no visibility. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Traders use it alongside other technical indicators such as. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain. Trading without candlestick patterns is a lot like flying in the night with no visibility. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. Let’s break down the basics: Bearish candlesticks tell you when selling. Web learn about all the trading candlestick patterns that exist: Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Bullish, bearish, reversal, continuation and indecision with examples and explanation. These patterns typically consist of. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. A shooting star is a bearish reversal pattern. These patterns are formed by the. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web there are eight typical bearish candlestick patterns, which are examined below. Web 5 powerful bearish candlestick patterns. At some point, the opposing power gains enough control to try and push the price in the. Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock.Candlestick Patterns The Definitive Guide (2021)

Bearish Engulfing Candlestick Pattern PDF Guide

Mastering Bearish Candlestick Patterns 5 Powerful Insights

Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

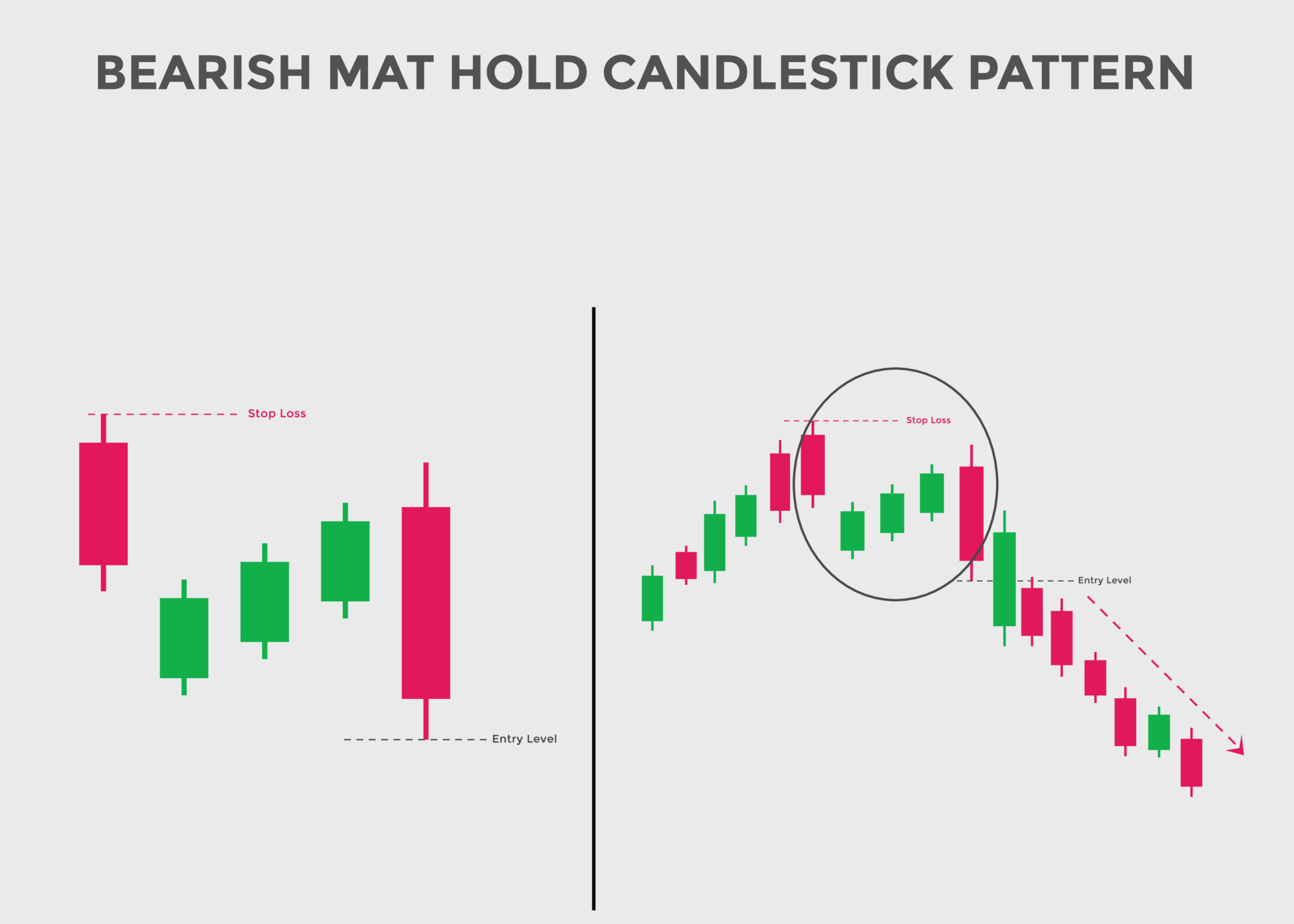

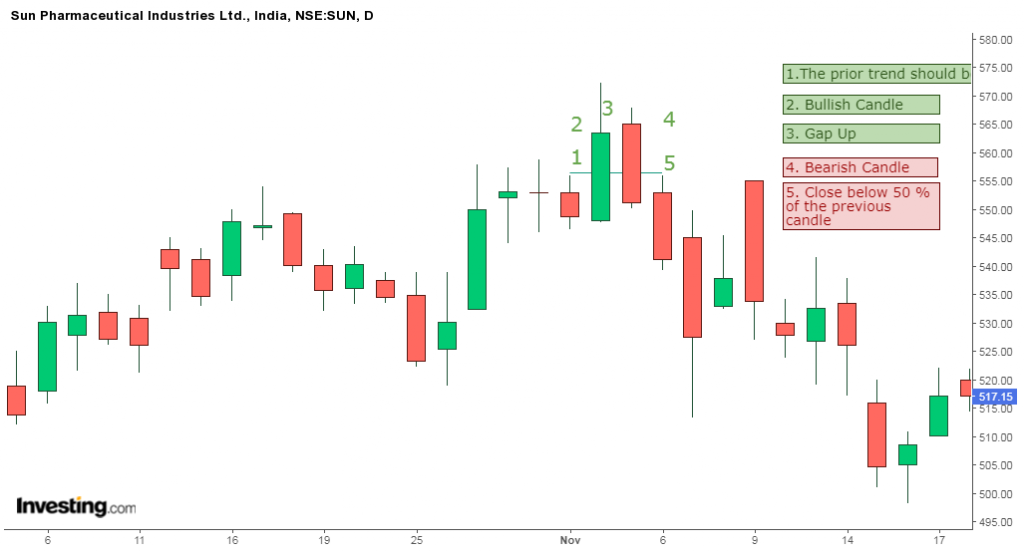

bearish mat hold candlestick patterns. Candlestick chart Pattern For

5 Powerful Bearish Candlestick Patterns

Candlestick Patterns Explained New Trader U

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish Reversal Candlestick Patterns The Forex Geek

5 Powerful Bearish Candlestick Patterns

Web Bearish Candlestick Patterns Usually Form After An Uptrend, And Signal A Point Of Resistance.

Web 8 Strongest Candlestick Patterns.

Web Bearish Candlestick Patterns Are Chart Formations That Signal A Potential Downtrend Or Reversal In The Market.

Web This Makes It Easier To Spot Patterns, Such As Bullish Or Bearish Engulfing Patterns, Doji Formations, And Morning Or Evening Stars, Which Are Vital For Predicting.

Related Post: